Crypto tax shouldn't be hard

Turn complex blockchain data into CPA approved tax reports

TurboTax

TrustPilot 4.8/5

1000+ sources

Your tax return in just a few minutes

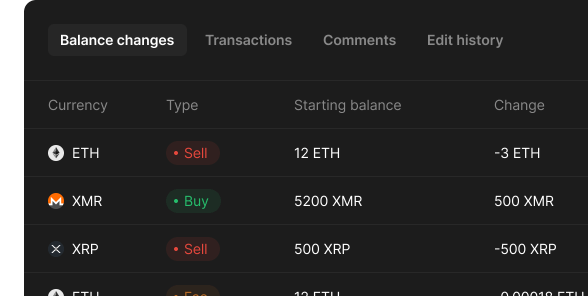

Easily import your trades

Add your exchange accounts via API or CSV files and connect your blockchain wallets using public addresses.

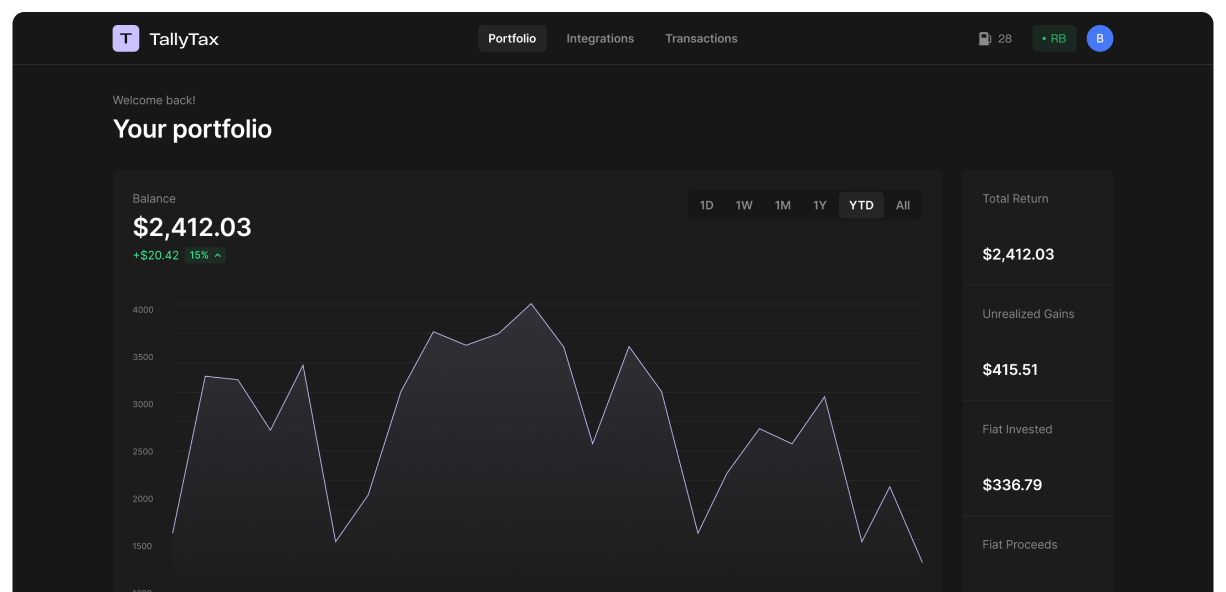

Detailed crypto tax return

Automatically calculate your overall portfolio value, the sum of your taxable transactions, and quickly get your profit or capital loss amount.

Tax saving opportunity

All your transactions clearly grouped by their tax impact with your potential savings opportunity highlighted.

Built to support CRA tax guidelines

Full support for the unique CRA reporting requirements, including Canada-specific rules around personal use, mining, staking and airdrops. Adjusted Cost Basis (ACB) and the Superficial Tax Loss rule are also supported.

Supports complex activity

Trading on the wild side of crypto? Your activity is supported, no matter how far you’ve fallen down the rabbit hole.

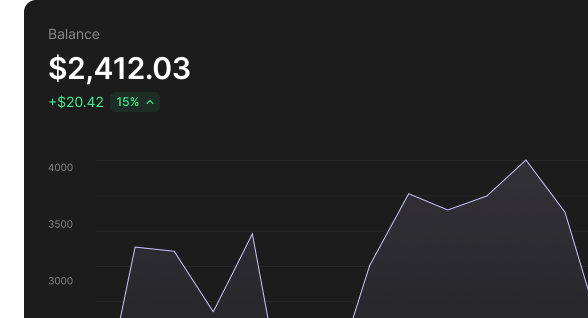

Be confident in the numbers

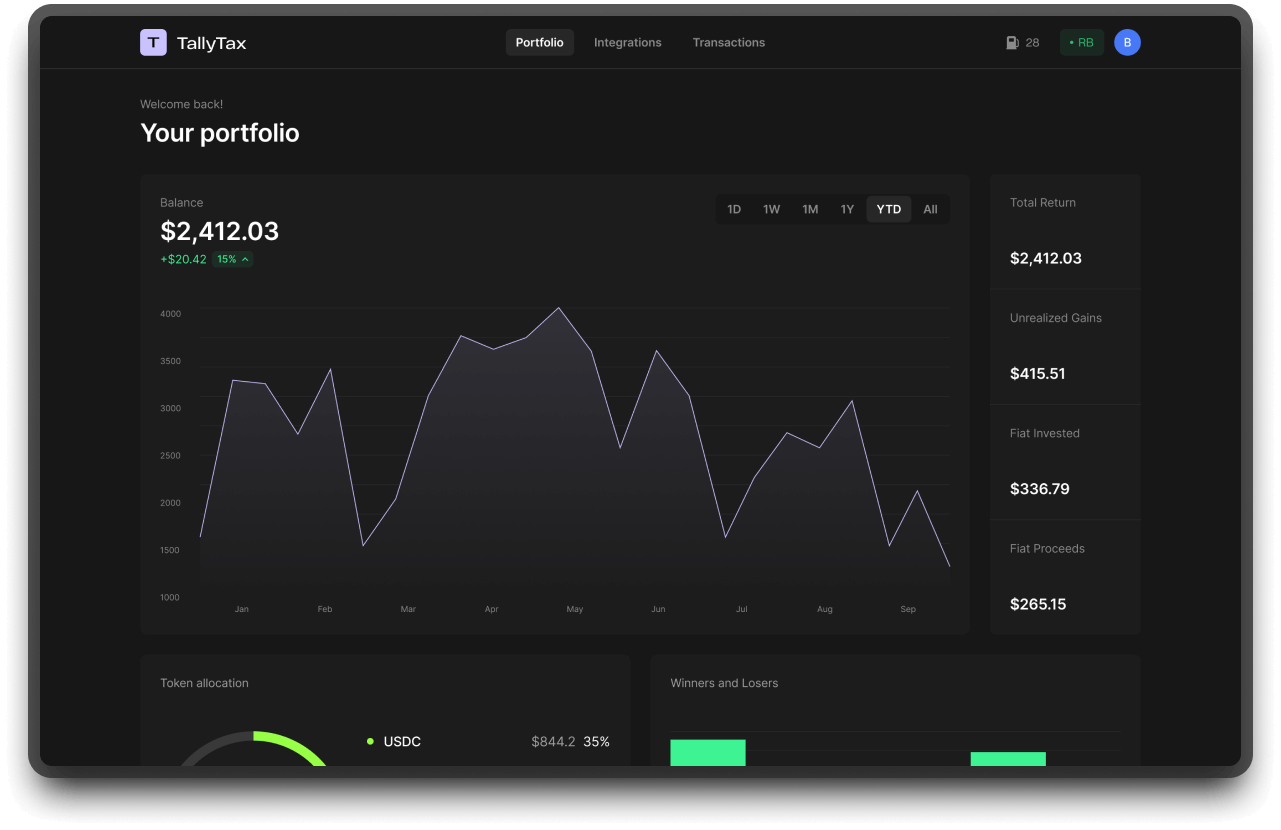

Easily see what's going on across all your wallets and exchanges so you can make the best decisions at all times.

Make compliance a breeze

Fully automated from start to finish. Seamlessly import all your transactions, follow the automated workflow and get your audit-proof tax reports with ease.

Every tax report you need

TurboTax PDF

View sample

Capital gains

View sample

Income

View sample

Expenses

View sample

Audit report

View sample

+12 other detailed reports

Tailored support for 1000+ sources

Fallen down the crypto rabbit hole? Don’t waste hours scouring block explorers and drowning in spreadsheets—import transactions automatically from over 1000 sources.

Features that make you work better

Features that make you work better

Features that make you work better

Features that make you work better

Features that make you work better

Features that make you work better

Features that make you work better

Features that make you work better

Features that make you work better

Features that make you work better

Features that make you work better

All in one portfolio tracker

Track your entire portfolio, PnL and tax liability all in the same place.

Full tax calculation transparency

See the exact breakdown of how each transaction is calculated. Understand the`why` and `how` behind your tax figures.

Built for speed

Optimised interface for bulk operations with keyboard shortcuts

Altcoin pricing oracle

300k+ currencies priced accurately on import. Historical prices for all micro-cap memecoins.

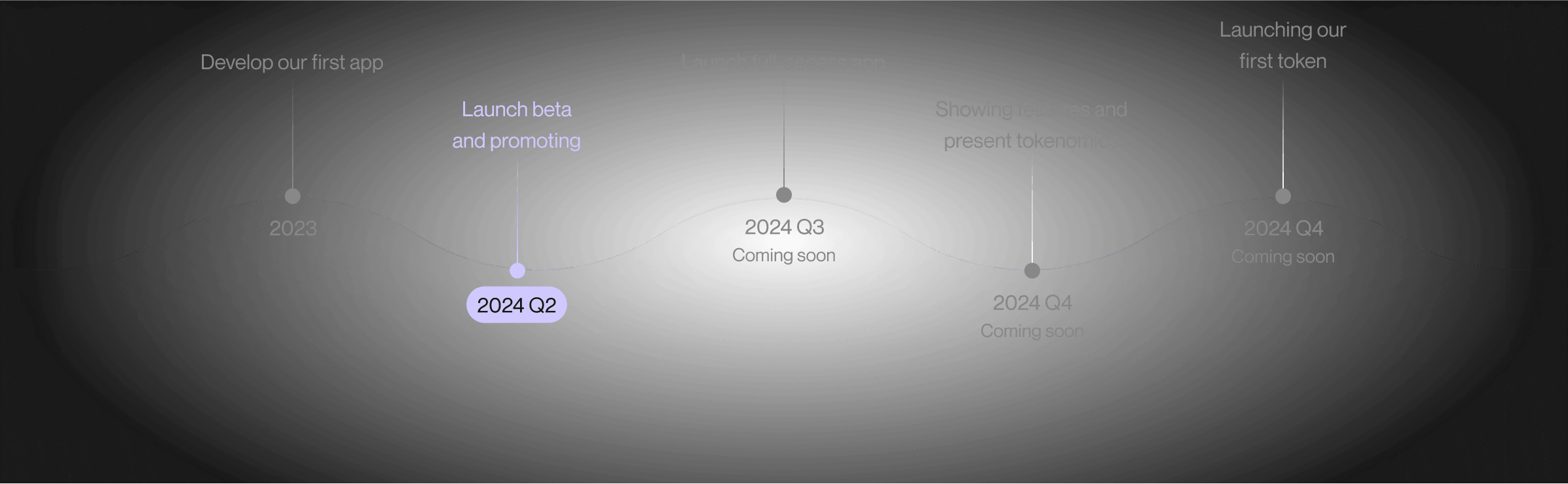

Our Roadmap

See the milestones that brought us here, and get a sneak peak of what's next.

Frequently Asked Questions

At CTC we design our product with security in mind, we follow industry standard best practices to keep your data safe.

How is crypto tax calculated?

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction, and your individual circumstances. For example, you might need to pay capital gains on profits from buying and selling cryptocurrency, or pay income tax on interest earned when holding crypto.

I lost money trading cryptocurrency. Do I still pay tax?

The way cryptocurrencies are taxed in Canada mean that investors might still need to pay tax, regardless of if they made an overall profit or loss. Depending on your circumstances, taxes are usually realised at the time of the transaction, and not on the overall position at the end of the financial year.

How do I calculate tax on crypto to crypto transactions?

In Canada you are required to record the value of the cryptocurrency in your local currency at the time of the transaction. This can be extremely time consuming to do by hand, since most exchange records do not have a reference price point, and records between exchanges are not easily compatible.

How can TallyTax help with crypto taxes?

You just need to import your transaction history and we will help you categorize your transactions and calculate realized profit and income. You can then generate the appropriate reports to send to your accountant and keep detailed records handy for audit purposes.

Can't I just get my accountant to do this for me?

We always recommend you work with your accountant to review your records. If you would like your accountant to help reconcile transactions, you can invite them to the product and collaborate within the app. We also have a complete accountant suite aimed at accountants.

Do you handle non-exchange activity?

We handle all non-exchange activity, such as onchain transactions like Airdrops, Staking, Mining, ICOs, and other DeFi activity. No matter what activity you have done in crypto, we have you covered with our easy to use categorization feature, similar to Expensify.

Do I have to pay for historical tax reports?

Our subscription pricing is per year not tax year, so with an annual subscription you can calculate your crypto taxes as far back as 2013. The process is the same, just upload your transaction history from these years and we can handle the rest.

How does payment work?

We have an annual subscription which covers all previous tax years. If you need to amend your tax return for previous years you will be covered under the one payment. We also offer a 30 day 100% money back guarantee, where if you contact our support team you can collect a full refund.

Can I use my own accountant?

Yes, TallyTax is designed to generate accountant friendly tax reports. You simply import all your transaction history and export your report. This means you can get your books up to date yourself, allowing you to save significant time, and reduce the bill charged by your accountant. You can discuss tax scenarios with your accountant, and have them review the report.

What if my exchange is not on the list of supported exchanges?

We cover hundreds of exchanges, wallets, and blockchains, but if you do not see your exchange on the supported list we are more than happy to work with you to get it supported.

Do you support NFT transactions?

We do! We have integrations with many NFT marketplaces, as well as categorization options for any NFT related activity (minting, buying, selling, trading).

How does the free trial work?

The platform is free to use immediately upon signup, allowing you to import your transactions and take advantage of our smart suggestion and auto-categorization engine, portfolio tracking, DeFi and NFT support. For access to reports, the tax loss harvest tool or chat and priority support, you will need to upgrade to the appropriate paid plan.

Get started for free

Import your transactions and generate a free report preview